Ferrous – The American Iron and Steel Institute reports that “For the week ending October 26, 2019, domestic raw steel production was 1,866,000 net tons while the capability utilization rate was 80.7 percent.

Production was 1,877,000 net tons in the week ending October 26, 2018 while the capability utilization then was 80.1 percent. The current week production represents a 0.6 percent decrease from the same period in the previous year. Production for the week ending October 26, 2019 is up 1.4 percent from the previous week ending October 19, 2019 when production was 1,841,000 net tons and the rate of capability utilization was 79.6 percent.”

Looking forward, AMM reports that U.S. steel expects market conditions to improve next year following challenging 4th quarter conditions: “President and chief executive officer David Burritt agreed that "next year, prices could come back," noting that sheet prices are already up about $20 per ton ($1 per hundredweight) after a round of mill price increases a week earlier. "Lead times have extended and our flat-rolled order rates have materially improved," the CEO said.”

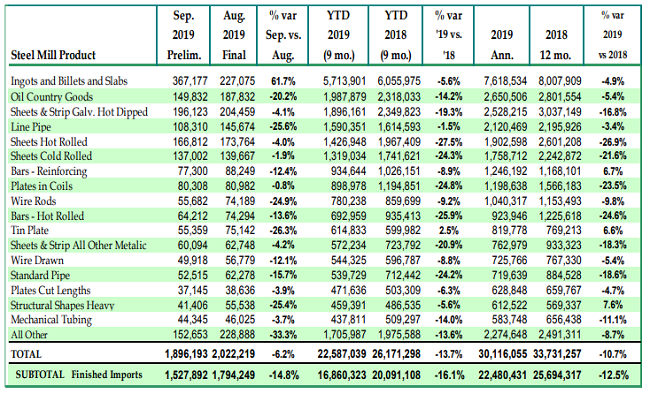

Diminished import competition could help. According to AISI, “through the first nine months of 2019, total and finished steel imports are 22,587,000 and 16,860,000 net tons (NT), down 13.7% and 16.1%, respectively, vs. the same period in 2018.”

U.S. Steel Mill Production Imports

Nonferrous –

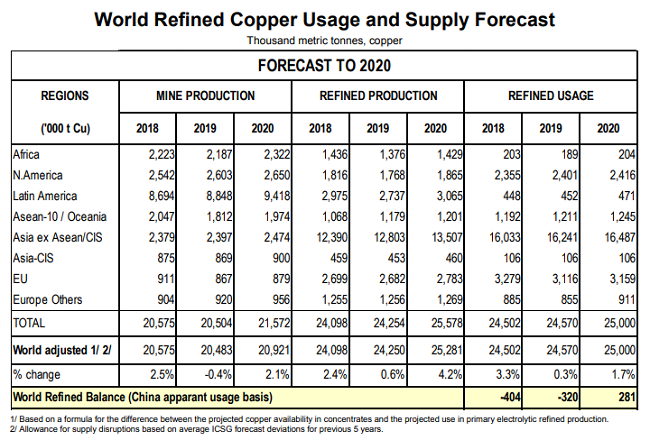

According to our friends at the International Copper Study Group, the global refined copper market is expected to swing from a 320,000 ton supply deficit this year to a 281,000 ton supply surplus in 2020. Copper mine production next year is expected to increase 2.1 percent next year to more than 20.9 million metric tons, “…mainly resulting from the ramp-up of recently commissioned mines together with a recovery in Indonesian output and improved production in Africa,” according to ICSG’s latest forecasts.

Reporting from LME week last week, Fastmarkets notes that Aurubis sees a more balanced European copper market going forward: “Aurubis, Europe’s largest copper producer, sees the domestic copper cathode market balanced, while the company’s multi-metal strategy will see it better adjust to the region’s changing trade landscape, chairman of the executive board Roland Harings told Fastmarkets in an interview during LME Week. The German-based producer has had a tempestuous year of change, with a leadership restructuring in June ushering in Harings. The producer’s Future Complex Metallurgy (FCM) project, which was planned to reduce capacity bottlenecks at its Hamburg plant, was also scrapped. Yet in a market currently characterized by poor demand and fragile premiums, Harings maintained broad stability across the European copper market, with further opportunities for new investment both upstream and downstream still emerging…

“Aurubis’ acquisition of Belgian-based metal recycler Metallo-Chimique in May helped sow the seeds for what the producer has now titled its multi-metal strategy - one that it now plans to execute as its key business strategy toward metals. The move, while still awaiting approval from the European Commission in regards to anti-trust and competition laws, will allow Aurubis to now diversify its intake of material and further progress production in line with trying market conditions. For copper, Metallo’s production of grade-B copper-nickel anodes is a prime example of this diversification. With grade-B anodes holding 3-4% nickel concentrate, Aurubis previously diluted the nickel to create a cleaner, copper-only product. Yet Metallo’s copper anodes have a key consumption base in Asia, allowing Aurubis to further bolster its flow sheet, while the Belgian recycler also produces some of the world’s highest quality tin, with lead content below 20 parts per million (ppm). Equally, continued demand for scrap material amid China’s category 6 and 7 ban of imports earlier this year has further justified the Metallo acquisition, in which Aurubis paid $424 million.”

Recovered Paper –

In corporate news, RISI reports that:

- “WestRock is closing its Newark, NJ, corrugated plant, affecting more than 100 employees, reports in New Jersey said. "We had extra capacity in some of our other facilities, and in order to stay competitive, we are moving production to some of those facilities," a company official told local media. "The decision to close this plant … is a strategic decision based on an analysis of the profitability, capacity, and future potential of the plants in this area," the company was quoted as saying.”

- “Pratt Industries' recycling subsidiary is to open its 20th US material recovery facility (MRF) on Nov. 1, a 40,000-ft2 plant in Houston that will work with the converting plant Pratt already has in that Texas city as the company sees continued growth in its corrugated box business in the Southwest, a company official told Fastmarkets RISI's PPI Pulp & Paper Week on Oct. 29. Pratt Industries is the largest 100% recycled packaging company in the USA. The Houston MRF will bale and shred between 2,000-4,000 tons/month of recovered fiber, including old corrugated containers (OCC), mixed paper, and high grades from nearby commercial and industrial accounts, which will then be sold back to Pratt's Shreveport, LA, paper mill. Pratt Recycling also has a MRF in Shreveport.”

- “ND Paper's Fairmont, WV, mill is producing a mixed paper pulp, or recycled pulp, of solely mixed paper, with other North American mills and a waste management company also considering this move, several contacts confirmed in the last week. The West Virginia mill's recycled pulp lines first ran in early 2019 on a considerable amount of mixed paper and old corrugated containers (OCC). The mill had shipped this recycled pulp to China by at least late February. Today, the former Resolute Forest Products market deinked pulp mill has exported the mixed paper pulp to China, contacts said.”