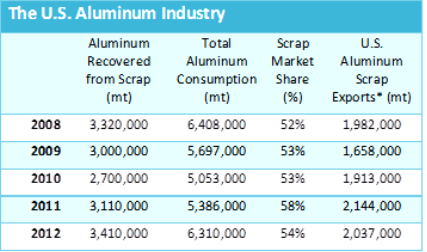

Aluminum holds the distinction of being both the youngest and the most widely used among all the base nonferrous metals in the U.S. Aluminum is known to be a lightweight, ductile, malleable and corrosion resistant metal, making it a popular choice with manufacturers. As with other nonferrous metals, aluminum is also inherently recyclable and recycled aluminum is highly valued as a raw material input for new aluminum production. In 2012, U.S. Geological Survey figures show aluminum metal recovered from purchased new and old scrap in the United States totaled over 3.4 million metric tons.

Aluminum can be recycled from a wide range of obsolete products including used beverage containers, aluminum siding, old radiators, used wire and cable, automobile and truck wheels, as well as end of life vehicles and airplanes. ISRI estimates that aluminum recovered scrap represented 54% of total U.S. apparent aluminum consumption in 2012. In addition, the U.S. exported more than 2 million metric tons of aluminum scrap worldwide last year.

Of the 3.4 million tons of aluminum recovered from purchased scrap in the United States late year, USGS estimates that about 53% came from new (manufacturing) scrap and 47% from old scrap (discarded aluminum products). The aluminum recovered from old scrap, such as aluminum cans and other obsolete products was equivalent to about 35% of total U.S. apparent consumption of aluminum, according to the USGS figures.

By type of consumer, the government statistics show that secondary smelters, which use aluminum scrap to create a variety of new aluminum and aluminum alloy shapes including ingots, sows, and other products, were by far the largest consumers of domestically purchased aluminum scrap last year, recovering over 1.9 million metric tons of aluminum by metallic content. The next largest consumers of aluminum scrap in 2012 (In order) were independent mill fabricators (1.4 million metric tons), foundries (97,000 metric tons) and other consumers (7,000 metric tons).

At the start of 2014, the light metal provided a prime example of a market in search of balance. While more than 5.4 million metric tons of aluminum are hoarding in LME warehouses, world aluminum production continues to rise. Figures from the International Aluminum Institute show reported and unreported aluminum production in China alone surpassed 24 million during 2013, a 10 percent increase from the corresponding period in 2012. Concerns about excess aluminum supply, investment outflows from commodities and the coming changes to LME warehouse load-out rate rules have weighed on aluminum market sentiment and prices. The average LME official 3-month aluminum price fell from $2,049 a ton in 2012 to $1,887 a ton in 2013. The LME rules changes are intended to reduce the time it takes to receive metal deliveries from LME warehouses, which could cut into the physical market premiums. But as of early January those premiums rose to record levels, prompting analysts to speculate that aluminum stocks could simply shift to off-exchange warehouses. And while Alcoa, Inc. expects global aluminum demand growth of 7 percent in 2014, most analysts expect the global aluminum market to remain in surplus this year. Should prices continue to fall; further production cutbacks could be on the cards. To sum up, considering this current scenario, the significance of aluminium scrap as a raw material input for aluminum production increases manifold and it calls for a much organized and strategic system for aluminium scrap collection and recycling.

Joseph C. Pickard is the Chief Economist and Director of Commodities for Recycling Materials Association This blog entry was originally posted on AL Circle Editorial Blog.