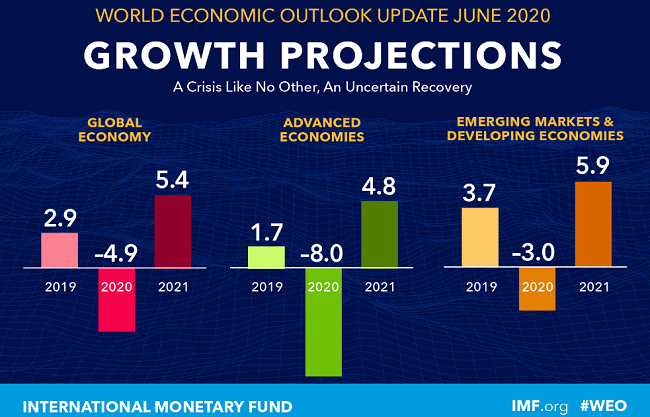

Last week, The International Monetary Fund released updated global economic projections as part of their “World Economic Outlook Update, June 2020” report. As compared to their previous forecasts in April when the global economy was projected to contract 3% in 2020, the IMF is now projecting a 4.9% contraction this year.

Downwardly Revised Growth Forecasts

The IMF projects U.S. output will decline 8.0 percent in 2020 and rise in 2021 by 4.5 percent. Advanced economies (-8% in 2020) are expected to be impacted more negatively than emerging markets and developing economies (-3% in 2020) and rebound more slowly.

The IMF reports “Based on downside surprises in the first quarter and the weakness of high-frequency indicators in the second quarter, this updated forecast factors in a larger hit to activity in the first half of 2020 and a slower recovery path in the second half than envisaged in the April 2020 WEO. For economies where infections are declining, the slower recovery path in the updated forecast reflects three key assumptions: persistent social distancing into the second half of 2020, greater scarring from the larger-than-anticipated hit to activity during the lockdown in the first and second quarters, and a negative impact on productivity as surviving businesses enhance workplace safety and hygiene standards. For economies still struggling to control infection rates, the need to continue lockdowns and social distancing will take an additional toll on activity. An important assumption is that countries where infections have declined will not reinstate stringent lockdowns of the kind seen in the first half of the year, instead relying on alternative methods if needed to contain transmission (for instance, ramped-up testing, contact tracing, and isolation).

U.S. Gross Domestic Product

Real GDP decreased 5.0 percent in the first quarter 2020, according to the third estimate which includes more complete source data, released last week by the Bureau of Economic Analysis. While this is the same decrease as the second estimate, the third estimate shows a positive nonresidential fixed investment increase, offset by downward revisions to private inventory investment, personal consumption expenditures, and exports (mainly of services and travel).

Services were down in the first quarter with the following services leading the decline:

- Healthcare services were down $100 billion;

- Household consumption expenditures for services were down $289 billion;

- Food services and accommodations fell $77.3 billion.

A few sectors added to first quarter growth:

- Residential investment up $25.8 billion;

- Food and beverages purchased for off-premises consumption up $68.2 billion;

- Final consumption expenditures of nonprofit institutions serving households up $65.3 billion;

- Net exports of goods and services up $84.1 billion.

Durable Goods Orders Up 15.8 Percent

May 2020 showed significant increases for durable goods manufacturers’ shipments, new orders and unfilled orders, on a seasonally adjusted basis (SA) reversing two months of declines.

New Orders

- New orders for durable goods in May 2020 increased 15.8 percent to $194.4 billion, following an 18.1 percent decline in April.

- New orders for durable goods, year to date through May 2020 compared to the same period in 2019, are down 13.6 percent to $1.043 trillion (not seasonally adjusted NSA).

- Transportation equipment led the May 2020 increase, rising 80.7 percent to $46.9 billion (SA).

- Motor vehicles and parts rose 27.5 percent to $28.2 billion (SA).

Shipments

- Manufacturers’ shipments of durable goods in May 2020 rose 4.4 percent to $198.5 billion, following an 18.6 percent decrease in April.

- Year to date through May 2020 compared with the same period in 2019, shipments are down 11.3 percent to $1.098 trillion (NSA).

- Motor vehicles and parts led the May 2020 increase, rising 26.7 percent to $28.3 billion (SA).

Unfilled Orders

- Unfilled orders edged up slightly in May 2020 by 0.1 percent to $1.109 trillion (SA), following a 1.5 percent decline in April.

- Year to date through May 2020 compared with the same period in 2019, are down 4.1 percent to $1,111 trillion.

- Primary metals led the May 2020 increase, rising 1.0 percent to $30.6 billion.

- Computer and related products were down in May 2020 by 1.7 percent to $1.9 billion.

Inventories

- In anticipation of future growth, inventories edged upward by 0.1 percent to $425.1 billion (SA), following two months of decline.

- Year to date through May 2020 compared with the same period in 2019, inventories are up 2.7 percent to $427.4 billion (NSA).

- Nondefense aircraft and parts led the May 2020 inventories increasing 1.6 percent to $74.8 billion.

- Computer and related products inventories increased 1.2 percent in May 2020 to $3.9 billion (SA).

- Inventories for primary metals fell the most in May 2020, dropping 1.8 percent to $34.9 billion (SA).

University of Michigan Surveys of Consumers – Preliminary Results

All three indexes, final results for June 2020, released last week by the University of Michigan showed significant gains over May 2020, even though all three indexes were revised downward from their preliminary results published mid-June:

- The Index of Consumer Sentiment was up 8.0 percent, and the index revised downward by 0.8;

- The Current Economic Conditions was up 5.8 percent, and the index revised downward by 0.7;

- The Index of Consumer Expectations was up 9.7 percent, and the index revised downward 0.8.

According to a statement released by the Surveys of Consumers chief economist, Richard Curtin: “While most consumers believe that economic conditions could hardly worsen from the recent shutdown of the national economy, prospective growth in the economy is more closely tied to progress against the coronavirus. The early reopening of the economy has undoubtedly restored jobs and incomes, but it has come at the probable cost of an uptick in the spread of the virus…

The resurgence of the virus will be accompanied by weaker consumer demand among residents of the Southern and Western regions and may even temper the reactions of consumers in the Northeast. As a result, the need for additional fiscal policies to relieve financial hardships has risen. Unfortunately, confidence in government economic policies has fallen in the June survey to its lowest level since Trump entered office. The need for new relief programs is urgent and would best be accomplished before the national elections dominate the debate.”