Economic projections and forecasts for 2024 are somewhat optimistic, a possible bright light for recyclers. Domestically, job growth is expected to continue, the Fed is expected to cut rates, but the manufacturing sector may still remain soft. Internationally, trade restrictions and geo-political risk put the global economy in a precarious situation.

Domestic

For the year, total nonfarm payrolls rose by 2.7 million seasonally adjusted (SA) (average monthly gain of 225,000), slower than the gain of 4.8 million jobs SA in 2022 (average monthly gain of 399,000). Without seasonal adjustment, the average monthly job gain in 2023 was 240,000. While continued job growth is certainly good for the economy and the recycled materials industry, investors remain wary that strong economic conditions will delay Fed rate cuts in 2024.

Throughout 2023 the Fed continued its interest rates hikes — raising interest rates 11 times between March of 2022 and July of 2023. The inflation indicators continue to decline; however, they have a way to go. An upside risk, meaning lowering the effect of the target federal funds rate, is that the market is lowering market rates. This may be good for recyclers looking to borrow money. Current thought is that the Fed will begin lowering rates mid-2024.

A downside risk could be that rates were raised to high, too quickly, resulting in “the risk of a marked weakening of household balance sheets, possible negative spillovers from lower growth in some foreign economies, geopolitical risks, and lingering risks of further tightening in bank credit,” according to the minutes from the Federal Open Market Committee during their December 2023 meeting.

As part of their meeting, an updated economic projections table was released. Highlights of these changes from the current (December 2023) projection to the previous (September 2023) projection:

- Raised the real GDP growth rate forecast for 2023 by 0.5 percentage points to 2.6%.

- Lowered changes to the inflation indicators for 2023.

- The projected core PCE inflation rate was reduced 0.5 percentage points to 3.2%.

- Projected PCE Inflation rate was lowered by 0.5 percentage points to 2.8%.

- The unemployment rate forecast remained unchanged at 3.8%.

- The Federal Funds Rate forecast was lowered 0.2 percentage points to 5.4%.

- The projected inflation rate will not reach the Fed target of 2% until 2026.

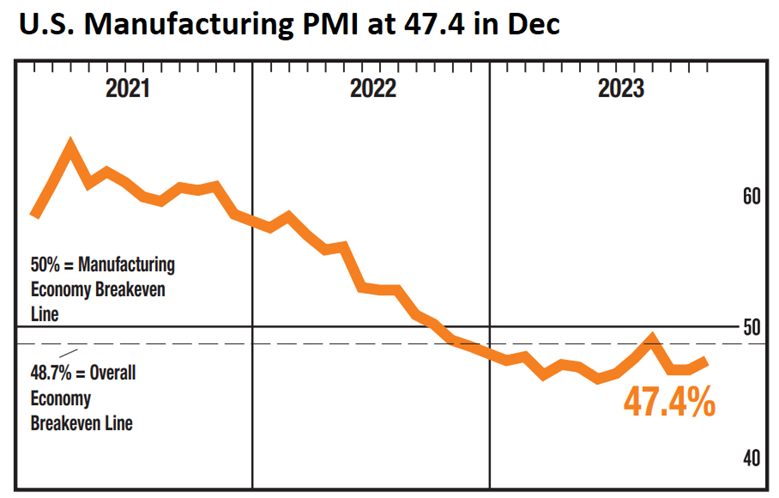

The manufacturing sector was soft throughout 2023 and looks to continue the trend in 2024. The Institute for Supply Management (ISM) reported that their U.S. Manufacturing Purchasing Managers Index (PMI) remained below the 50-threshold. The index has been below the 50-point threshold dividing expansion from contraction since November 2022. At 47.4 in December, ISM’s manufacturing PMI improved from the 46.7 reading in November but signaled contraction in the U.S. manufacturing sector for the 14th consecutive month. The U.S. manufacturing sector continued to contract, but at a slightly slower rate in December as compared to November. It is expected that 2024 will see more of the same.

International

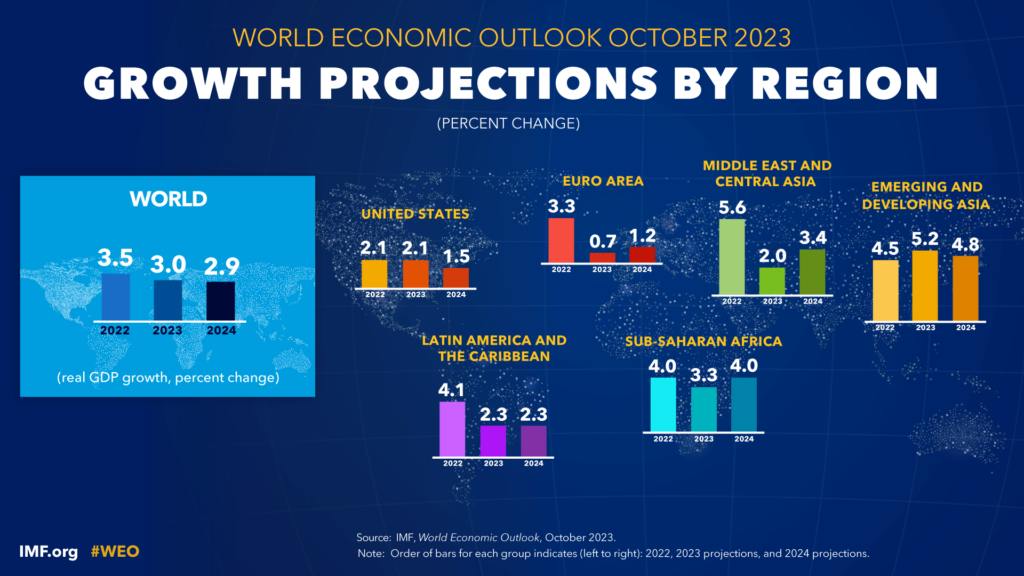

The International Monetary Fund (IMF) expects global growth in 2024 to be similar to 2023, forecasting a real growth domestic product (GDP) rate of 2.9% according to data from their World Economic Outlook published in October 2023. For the U.S., the IMF estimates a bit of cooling, forecasting that GDP for the year will grow about 1.5% — down from the 2.1% growth of 2023 and significantly lower than the growth projected by the Federal Reserve Board. It’s not yet known how the strong GDP numbers from the third quarter of 2023 will impact the current forecast.

One of the largest recycled materials trading partners is China, The IMF has held steady for half a year its growth forecasts for China: 5.0% in 2023 and 4.2% in 2024. The organization believes that the real estate crisis could further deepen in China, which poses an important risk for the global economy with global spillovers, particularly for commodity exporters.

Geo-political risk factors will continue to put pressure on the global economy. As the war in Ukraine and the Israeli-Hamas conflict continue, further strain will be placed on supply chains and trade in those areas will continue to be a perilous endeavor.

Growing trade restrictions remain an area of concern for the recycled materials industry. Fragile global supply chains, rising economic nationalism, confusion over what is product and what is “waste,” and how to properly account for recycling’s contribution to emissions savings have led to increased concerns about trade restrictions and protectionism.

This year could see potential expansions and revisions to the scope of multi-lateral agreements and regulations including the Basel Convention and European Waste Shipment Regulations, unintended consequences from trade agreements designed primarily to protect manufacturers in advanced economies, and national restrictions on recycled material imports and exports. All these actions pose risks to the global economy, environment, and recycling infrastructure.

On Dec. 19, the Office of the U.S. Trade Representative (USTR) and the European Commission announced an agreement that extended the suspension of the Section 232 tariffs on steel and aluminum imports from the EU into the U.S. market for 15 months. By extending the suspension to March 31, 2025, negotiators will have additional time to work out an agreement on the Global Arrangement on Sustainable Steel and Aluminum. One concern that could potentially stall negotiations is an agreement on how to define “green steel.” U.S. steelmakers are the global leader in the production of low carbon steel, with more than 70 percent of new steel produced using energy-efficient and lower emissions electric arc furnaces (EAFs). EAF steelmaking is a clean, innovative and energy efficient process that allows steelmakers to produce high-quality steel from 100 percent recycled material. While alternative steel standards may claim to be “green,” in reality, certain standards create a “sliding scale” that creates a dual standard that allows for high-carbon steel to be prioritized over low-carbon steel using recycled materials.

Amid the escalation in restrictive trade policy measures, ISRI’s Specifications provide clear guidelines on the recommended composition and allowable contamination limits on recycled material transactions. In addition to the specifications on the website, ReMA expects new specifications for copper and plastic for 2024.

Economic projections and forecasts for 2024 are somewhat optimistic, a possible bright light for recyclers....